Customer segmentation helps companies gain insight into a customer’s behavior and tailor services to meet their needs. At Cowrywise, a Nigerian fintech platform, we’re using Metabase to visualize these insights and provide solutions through a combination of:

- RFM (Recency, Frequency, and Monetary Value),

- AUM (Assets Under Management) per day metrics, and

- K-Means clustering.

Understanding RFM (Recency, Frequency, and Monetary)

RFM allows us to segment customers based on their transaction history, including:

- Time since their last transaction (recency),

- The number of transactions they have made (frequency), and

- The amount of money they have spent on the platform (monetary value). To calculate RFM, assign scores to each metric: recency, frequency, and monetary value. The highest scores indicate better engagement with your platform. For example, a customer who made a transaction yesterday, has made multiple transactions in the past, and has spent a significant amount of money on the platform receives a higher RFM score.

Below is the Python script we use to calculate RFM scores:

import pandas as pd

import datetime as dt

# Load transaction data

df = pd.read_csv("transactions.csv")

# Convert transaction_date to datetime

df["transaction_date"] = pd.to_datetime(df["transaction_date"])

# Calculate Recency, Frequency, and Monetary Value

snapshot_date = df["transaction_date"].max() + dt.timedelta(days=1)

df_rfm = df.groupby("user_id").agg({

"transaction_date": lambda x: (snapshot_date - x.max()).days,

"transaction_id": "count",

"amount": "sum"

}).reset_index()

# Rename columns

df_rfm.rename(columns={

"transaction_date": "Recency",

"transaction_id": "Frequency",

"amount": "MonetaryValue"

}, inplace=True)

# Print the first five rows of the RFM dataframe

print(df_rfm.head())

Adding AUM to RFM

The downside to RFM is that it ignores a customer’s investment behavior. As a way to gain a more holistic view of customer investment habits and behaviors, we add AUM (Assets Under Management) per day to RFM scores. AUM is the total value of assets that a customer has invested in, divided by the number of days since they started investing. Below is the script we use to create this hybrid metric:

# Load AUM data

df_aum = pd.read_csv("aum.csv")

# Convert start_date to datetime

df_aum["start_date"] = pd.to_datetime(df_aum["start_date"])

# Calculate the number of days since the customer started investing

df_aum["InvestmentDays"] = (snapshot_date - df_aum["start_date"]).dt.days

# Calculate AUM per day

df_aum["AUMperDay"] = df_aum["aum"] / df_aum["InvestmentDays"]

# Merge RFM and AUM dataframes

df_hybrid = pd.merge(df_rfm, df_aum[["user_id", "AUMperDay"]], on="user_id", how="inner")

# Print the first five rows of the hybrid dataframe

print(df_hybrid.head())

Using k-means clustering to group customers

Once RFM and AUM scores are calculated, we use k-means clustering to group customers based on these metrics. k-means clustering is an unsupervised machine learning algorithm that groups data points into k clusters based on their similarity. In this case, k represents the number of customer segments we want to create. We combine the RFM and AUM data into a single data frame. We then use the elbow method to determine the optimal number of clusters for our data. The elbow method, used in the example below, involves plotting the within-cluster sum of squares (WCSS) against the number of clusters. We select the number of clusters at the “elbow” of the plot, where adding more clusters doesn’t significantly reduce the WCSS. Below is the script we use to perform k-means clustering on our data. In our case, we choose four clusters as the optimal number of clusters. We fit the k-means clustering algorithm to our data and assign each customer to a cluster.

from sklearn.cluster import KMeans

# combine RFM and AUM data into a single dataframe

rfm_aum_data = pd.concat([rfm_scores, aum_scores], axis=1)

# determine optimal number of clusters using elbow method

wcss = []

for i in range(1, 11):

kmeans = KMeans(n_clusters=i, init='k-means++', max_iter=300, n_init=10, random_state=0)

kmeans.fit(rfm_aum_data)

wcss.append(kmeans.inertia_)

plt.plot(range(1, 11), wcss)

plt.title('Elbow Method')

plt.xlabel('Number of clusters')

plt.ylabel('WCSS')

plt.show()

# fit k-means clustering to data

kmeans = KMeans(n_clusters=4, init='k-means++', max_iter=300, n_init=10, random_state=0)

kmeans.fit(rfm_aum_data)

# assign clusters to each customer

customer_clusters = kmeans.predict(rfm_aum_data)

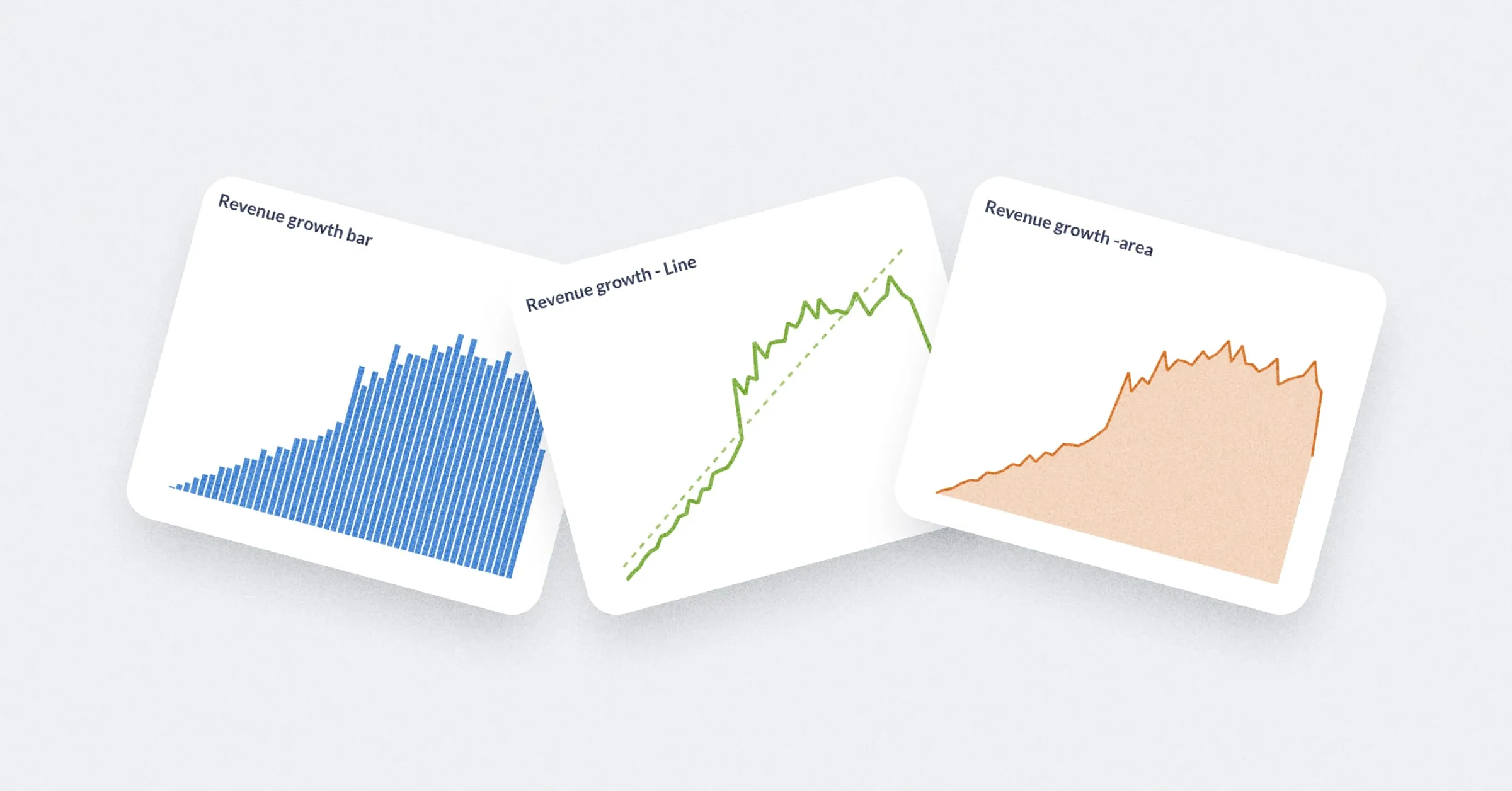

Visualizing the segments in Metabase

Once each customer is assigned to a cluster, you can begin visualizing customer segments in Metabase! First, make sure that you have a Metabase account and have connected Metabase to your data source. Once you’re connected:

- Select + New > Question.

- Select your

customer_segmentationtable as the starting point (or whatever you called your table that contains yourrfm_score,aum_per_day, andsegmentfields). - Once you have written your query, click Visualize to create your visualization.

- You can use the query builder to filter and summarize that data, then choose the type of visualization you want to use. For example, use a bar chart to show the distribution of customers across different segments, or a scatter plot to show the relationship between RFM score and AUM per day.

- When you have some interesting results, click on the Save button.

- You can add the saved question to a Metabase dashboard and set up filters so that people can view the data by segment, date range, or other variable you choose.