Financial analytics concepts

An overview of financial modeling concepts to help you think about how to track customers, revenue, and costs.

We’ll cover a lot of technical terms here so you can keep up with the kinds of questions investors and boards and accountants might throw at you, but we’re going to situate all of this jargon in the context of the fundamental concepts involved in financial modeling. Because it’s all really just different ways of counting money coming in and money going out.

Why startups need to model their finances sooner rather than later

The reason you need to count revenue and costs in different ways is so that you can:

- See how much money you’re actually making.

- See how much money you’re spending (and how you’re spending it).

- Forecast how much money you’re likely to make in the future.

- How much it’ll cost you to keep doing the same thing going forward (your runway).

- How much it would cost to expand your business (do you need to raise more money?).

- Where you can spend that money more wisely, i.e., what are the biggest levers you can pull that will increase revenue or reduce costs?

This guide focuses on subscription-based startups, but the principles should apply to any startup.

Core financial concepts

At its most basic, financial modeling is just about tracking money coming in, money going out, and the people paying you that money. Think of this section as background to contextualize the models and spreadsheets created by the financial modeling package and its template.

Customer flows

To estimate how many customers you can expect to acquire (or lose), it’s useful to think through the stages people go through when interacting with your company.

See Customer flows.

Revenue

Revenue is generally categorized by its timing: when you charge a customer, and when that money actually hits your bank account.

See Revenue.

Costs

Costs are generally categorized into four main buckets to help you understand how you’re spending your money.

See Costs.

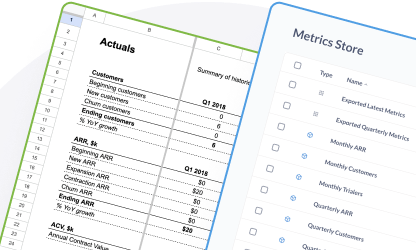

Financial modeling package

We also built a package that can magically output a metrics store for you based on these concepts. You’ll need a pretty specific setup to make use of the package, but even if you can’t use the package, you can check out its code and get a good idea of how the SQL puts together the numbers so that you can adapt the code to your own situation.

See the Financial modeling package