The Challenge: Yellow Card needed a simple way for teams to access and explore data on their own. Their previous BI tool slowed adoption, created a backlog of ad-hoc requests, and made the four-person data team a bottleneck for everyday questions.

The Solution: Metabase offered an easy Snowflake setup and a clear, intuitive interface that helped non-technical users start exploring data immediately. Its transparency and governance tools made it possible to widen access safely across the organization.

The Results: Teams now check metrics, validate ideas, and surface issues directly in Metabase, reducing dependence on the data team. With faster decisions and shared visibility into trusted metrics, Metabase has become Yellow Card’s primary place to understand what’s happening in the business.

"Metabase helped our data team step out of the gatekeeper role. Now anyone can explore data, question assumptions, and even spot issues before they reach us.

"

Moses Mung'ayi

Data Analyst at Yellow Card

Yellow Card is a global fintech company building stablecoin-based payment rails and cross-border settlement for both consumers and B2B clients. With ~200 employees and a lean four-person data team, they needed an analytics tool that was easy to set up, worked seamlessly with Snowflake, and helped the rest of the company ask and answer their own questions without waiting on analysts.

Metabase is now their central place to explore data, check product usage, support financial reporting, and collaborate across teams.

Yellow Card’s data team needed a fast and simple way to help teams access data without relying on constant ad-hoc requests. Their previous BI tool wasn’t intuitive, didn’t encourage adoption outside the data group, and made it difficult for people to explore or trust the data.

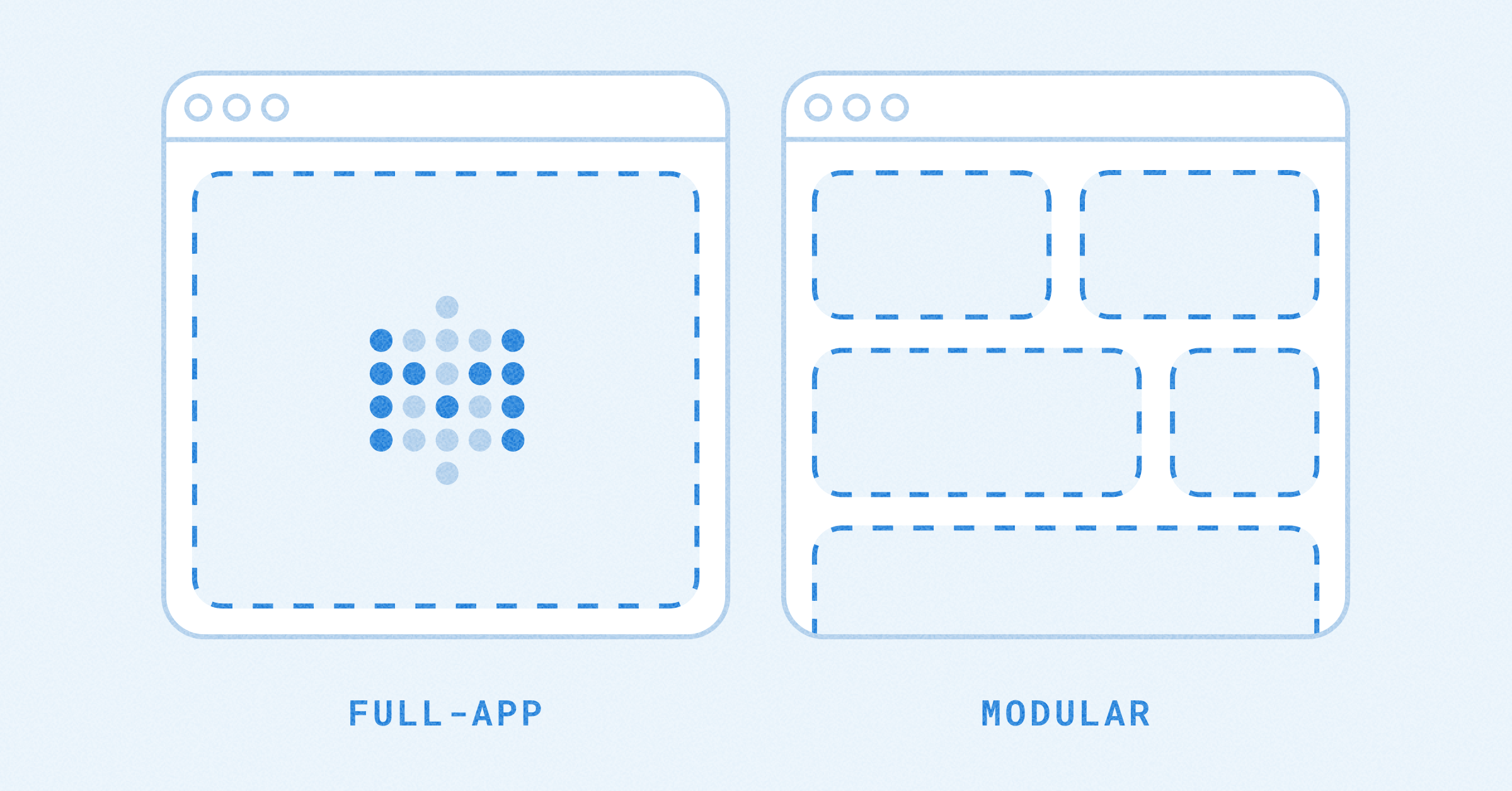

The team chose Metabase because it was easy to set up on top of Snowflake, simple enough for non-technical users, and transparent in how every metric and chart is built. The emphasis on self-service and openness aligned directly with Yellow Card’s goal to create a data-literate culture where insights aren’t locked behind a single team.

Today, product, finance, B2B customer experience, and operations teams log into Metabase daily or weekly, using it as their primary interface for understanding how the business is performing.

The data

Yellow Card uses Metabase on top of a modern, Snowflake-centric data stack.

- Sources: AWS DynamoDB and other internal systems

- Data Warehouse: Snowflake

- Pipelines: Mix of Fivetran and in-house pipelines

- BI Layer: Metabase

This setup allows the Yellow Card’s data team to maintain consistent definitions in Snowflake while giving business teams an easy, self-serve way to explore and understand data in Metabase.

Most teams at Yellow Card rely on Metabase to monitor product behavior, track financial and operational metrics, and answer day-to-day questions without waiting on analysts.

The data team uses several approaches to onboard users:

- 1:1 and team-specific training sessions when teams need help answering deeper questions

- Recorded walkthroughs explaining core dashboards and how their data is structured

- A shared homepage dashboard linking to the company’s key metrics and team-relevant data

Common patterns include:

- Product and UX teams checking usage metrics and validating hypotheses in real time

- Finance teams reviewing operational and reporting-related metrics

- B2B customer experience teams monitoring activity and support-related workflows

Yellow Card also uses Metabase’s governance features - collections, impersonation, and column-level permissions to safely widen access while keeping sensitive financial data protected. Usage analytics helps the team understand which dashboards are actually used and where cleanup is needed.

“If someone has a hypothesis, we open Metabase and test it on the spot. Filter, pivot, validate. It’s changed the pace of decision-making for us.” - says Moses.

The results

One of the biggest benefits Yellow Card saw from Metabase was a dramatic increase in data transparency and shared ownership. Teams outside of data now regularly spot anomalies, data-quality issues, or unexpected trends because they’re directly exploring the dashboards themselves, not waiting for scheduled reports.

Other improvements include:

- Less reliance on the data team: Non-technical users build their own charts, pivots, and dashboards.

- Faster decision-making: Analysts can validate or disprove hypotheses live during conversations, cutting hours or days of back-and-forth.

- Stronger trust in the data: Because every Question is inspectable, teams understand how metrics are defined and aren’t afraid to challenge or improve them.

- A small team supporting a large org: A data team of four can now support 200+ employees because so much exploration work happens directly in Metabase.

Metabase has become the primary way teams understand what’s happening across Yellow Card-strengthening their analytics culture and helping the whole organization move faster.